Dutch and British wholesale gas prices remained stable on Friday morning as warmer weather forecasts balanced out the increased demand anticipated from Asia for liquefied natural gas (LNG) deliveries.

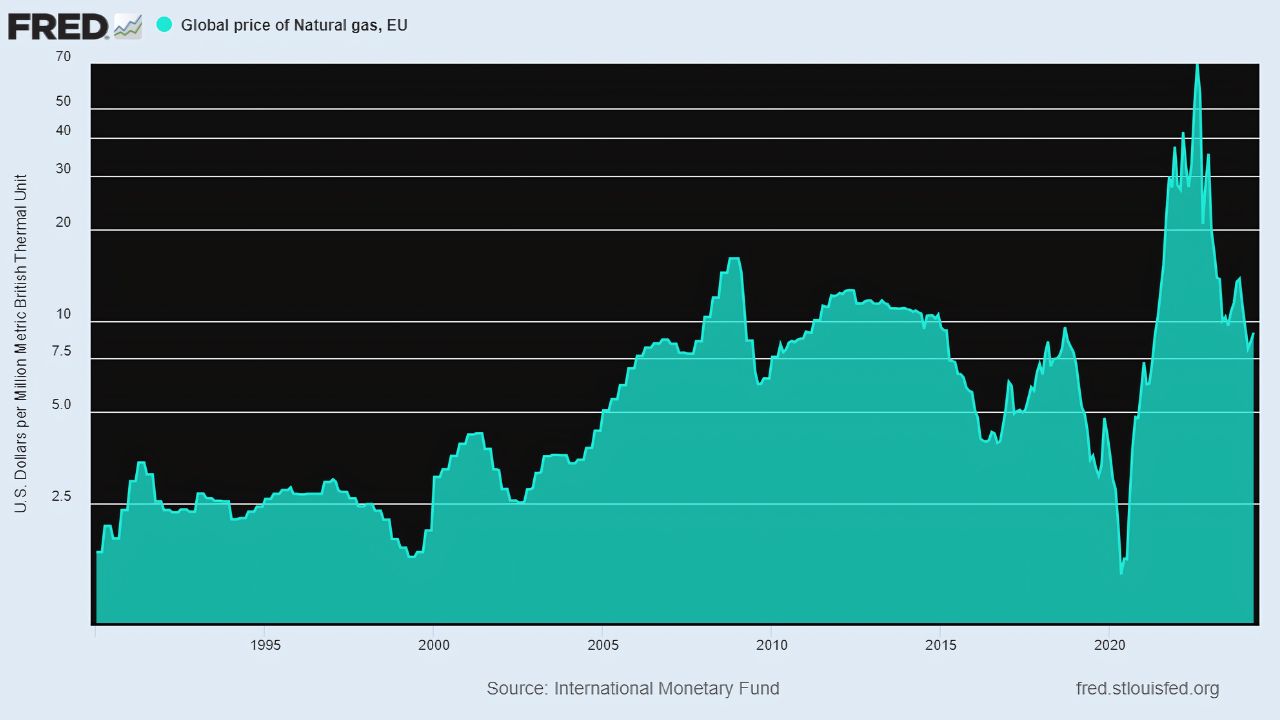

The benchmark front-month contract at the Dutch TTF hub decreased by 0.30 euros to 30.50 euros per megawatt hour (MWh) by 0821 GMT, after initially peaking at 31.20 euros/MWh earlier, marking the highest level since April 19, according to LSEG data.

Analysts at ING noted that the “extremely comfortable” current European gas storage levels at 63% capacity, along with milder weather predictions for the next two weeks and increased gas flows from Norway, have mitigated concerns over LNG supply shortages.

“We continue to maintain a bearish outlook on the European natural gas market,” they commented.

Recent weather forecasts indicated a stronger likelihood of high pressure systems over Northern Europe towards the end of next week, stated LSEG meteorologist Georg Mueller.

Norwegian gas supply nominations increased to 291.7 million cubic metres (mcm) per day on Friday morning, up from 283.2 mcm/day on Thursday, according to Gassco data.

On Thursday, Daniel Hynes, senior commodity strategist at ANZ bank, observed that “global gas prices rose as emerging supply-side issues threaten to hamper the replenishment of inventories next winter,” in his daily briefing.

Demand in Asia has risen due to a heatwave, while Egypt, typically an LNG exporter, has leased a floating LNG storage and regasification terminal (FSRU) to meet robust domestic demand, he pointed out.

The Hoegh Galleon FSRU will be stationed in Egypt from June 2024 to February 2026, announced the vessel’s owner, Hoegh.

Analysts at Energy Aspects highlighted that TTF prices under 32 euros/MWh, or $10/mmbtu, boost demand for LNG outside of Europe, especially around $7–8/mmbtu, or 22-25 euros/MWh.

They projected a 10 billion cubic metres (bcm) reduction in Europe’s supply from April to October compared to last year, mainly due to decreased LNG imports, with demand expected to decrease by 6 bcm to 165 bcm.

This reduction is still expected to allow sufficient injections for European storage to reach near full capacity by the end of October, they mentioned.

Furthermore, the Dutch day-ahead contract remained unchanged at 30.90 euros/MWh.

In the British market, while most contracts had not yet commenced trading, the weekend contract TRGBNBPWE dropped by 2.50 pence to 73.50 pence per therm, as shown by LSEG data.

In the European carbon market, the benchmark contract increased by 0.27 euros to 72.78 euros per metric ton.